Behavioral economic demand is gaining in popularity. The motivation

behind beezdemand was to create an alternative tool to

conduct these analyses. This package is not necessarily meant to be a

replacement for other softwares; rather, it is meant to serve as an

additional tool in the behavioral economist’s toolbox. It is meant for

researchers to conduct behavioral economic (be) demand the easy (ez)

way.

Currently, this version (0.1.0) is the first minor release and is stable. I encourage you to use it but be aware that, as with any software release, there might be (unknown) bugs present. I’ve tried hard to make this version usable while including the core functionality (described more below). However, if you find issues or would like to contribute, please open an issue on my GitHub page or email me.

The latest stable version of beezdemand (currently

v.0.1.0) can be found on CRAN and

installed using the following command. The first time you install the

package, you may be asked to select a CRAN mirror. Simply select the

mirror geographically closest to you.

install.packages("beezdemand")

library(beezdemand)To install a stable release directly from GitHub, first

install and load the devtools package. Then, use

install_github to install the package and associated

vignette. You don’t need to download anything directly from GitHub, as you

should use the following instructions:

install.packages("devtools")

devtools::install_github("brentkaplan/beezdemand", build_vignettes = TRUE)

library(beezdemand)To install the development version of the package, specify the

development branch in install_github:

devtools::install_github("brentkaplan/beezdemand@develop")An example dataset of responses on an Alcohol Purchase Task is

provided. This object is called apt and is located within

the beezdemand package. These data are a subset of from the

paper by Kaplan

& Reed (2018). Participants (id) reported the number of

alcoholic drinks (y) they would be willing to purchase and consume at

various prices (x; USD). Note the format of the data, which is called

“long format”. Long format data are data structured such that repeated

observations are stacked in multiple rows, rather than across columns.

First, take a look at an extract of the dataset apt, where

I’ve subsetted rows 1 through 10 and 17 through 26:

| id | x | y | |

|---|---|---|---|

| 1 | 19 | 0.0 | 10 |

| 2 | 19 | 0.5 | 10 |

| 3 | 19 | 1.0 | 10 |

| 4 | 19 | 1.5 | 8 |

| 5 | 19 | 2.0 | 8 |

| 6 | 19 | 2.5 | 8 |

| 7 | 19 | 3.0 | 7 |

| 8 | 19 | 4.0 | 7 |

| 9 | 19 | 5.0 | 7 |

| 10 | 19 | 6.0 | 6 |

| 17 | 30 | 0.0 | 3 |

| 18 | 30 | 0.5 | 3 |

| 19 | 30 | 1.0 | 3 |

| 20 | 30 | 1.5 | 3 |

| 21 | 30 | 2.0 | 2 |

| 22 | 30 | 2.5 | 2 |

| 23 | 30 | 3.0 | 2 |

| 24 | 30 | 4.0 | 2 |

| 25 | 30 | 5.0 | 2 |

| 26 | 30 | 6.0 | 2 |

The first column contains the row number. The second column contains the id number of the series within the dataset. The third column contains the x values (in this specific dataset, price per drink) and the fourth column contains the associated responses (number of alcoholic drinks purchased at each respective price). There are replicates of id because for each series (or participant), several x values were presented.

Take for example the format of most datasets that would be exported from a data collection software such as Qualtrics or SurveyMonkey or Google Forms:

## the following code takes the apt data, which are in long format, and converts

## to a wide format that might be seen from data collection software

wide <- spread(apt, x, y)

colnames(wide) <- c("id", paste0("price_", seq(1, 16, by = 1)))

knitr::kable(wide[1:5, 1:10])| id | price_1 | price_2 | price_3 | price_4 | price_5 | price_6 | price_7 | price_8 | price_9 |

|---|---|---|---|---|---|---|---|---|---|

| 19 | 10 | 10 | 10 | 8 | 8 | 8 | 7 | 7 | 7 |

| 30 | 3 | 3 | 3 | 3 | 2 | 2 | 2 | 2 | 2 |

| 38 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 3 | 3 |

| 60 | 10 | 10 | 8 | 8 | 6 | 6 | 5 | 5 | 4 |

| 68 | 10 | 10 | 9 | 9 | 8 | 8 | 7 | 6 | 5 |

A dataset such as this is referred to as “wide format” because each

participant series contains a single row and multiple measurements

within the participant are indicated by the columns. This data format is

fine for some purposes; however, for beezdemand, data are

required to be in “long format” (in the same format as the example data

described earlier). In order to convert to the

long format, some steps will be required.

First, it is helpful to rename the columns to what the prices actually were. For example, for the purposes of our example dataset, price_1 was $0.00 (free), price_2 was $0.50, price_3 was $1.00, and so on.

## make an object to hold what will be the new column names

newcolnames <- c("id", "0", "0.5", "1", "1.50", "2", "2.50", "3",

"4", "5", "6", "7", "8", "9", "10", "15", "20")

## current column names

colnames(wide) [1] "id" "price_1" "price_2" "price_3" "price_4" "price_5"

[7] "price_6" "price_7" "price_8" "price_9" "price_10" "price_11"

[13] "price_12" "price_13" "price_14" "price_15" "price_16"## replace current column names with new column names

colnames(wide) <- newcolnames

## how new data look (first 5 rows only)

knitr::kable(wide[1:5, ])| id | 0 | 0.5 | 1 | 1.50 | 2 | 2.50 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 15 | 20 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 19 | 10 | 10 | 10 | 8 | 8 | 8 | 7 | 7 | 7 | 6 | 6 | 5 | 5 | 4 | 3 | 2 |

| 30 | 3 | 3 | 3 | 3 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 1 | 1 | 1 | 1 |

| 38 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 3 | 3 | 3 | 3 | 2 | 2 | 2 | 0 | 0 |

| 60 | 10 | 10 | 8 | 8 | 6 | 6 | 5 | 5 | 4 | 4 | 3 | 3 | 2 | 2 | 0 | 0 |

| 68 | 10 | 10 | 9 | 9 | 8 | 8 | 7 | 6 | 5 | 5 | 5 | 4 | 4 | 3 | 0 | 0 |

Now we can convert into a long format using some of the helpful

functions in the tidyverse package (make sure the package

is loaded before trying the commands below).

## using the dataframe 'wide', we specify the key will be 'price', the values

## will be 'consumption', and we will select all columns besides the first ('id')

long <- tidyr::gather(wide, price, consumption, -id)

## we'll sort the rows by id

long <- arrange(long, id)

## view the first 20 rows

knitr::kable(long[1:20, ])| id | price | consumption |

|---|---|---|

| 19 | 0 | 10 |

| 19 | 0.5 | 10 |

| 19 | 1 | 10 |

| 19 | 1.50 | 8 |

| 19 | 2 | 8 |

| 19 | 2.50 | 8 |

| 19 | 3 | 7 |

| 19 | 4 | 7 |

| 19 | 5 | 7 |

| 19 | 6 | 6 |

| 19 | 7 | 6 |

| 19 | 8 | 5 |

| 19 | 9 | 5 |

| 19 | 10 | 4 |

| 19 | 15 | 3 |

| 19 | 20 | 2 |

| 30 | 0 | 3 |

| 30 | 0.5 | 3 |

| 30 | 1 | 3 |

| 30 | 1.50 | 3 |

Two final modifications we will make will be to (1) rename our

columns to what the functions in beezdemand will expect to

see: id, x, and y, and (2) ensure

both x and y are in numeric format.

colnames(long) <- c("id", "x", "y")

long$x <- as.numeric(long$x)

long$y <- as.numeric(long$y)

knitr::kable(head(long))| id | x | y |

|---|---|---|

| 19 | 0.0 | 10 |

| 19 | 0.5 | 10 |

| 19 | 1.0 | 10 |

| 19 | 1.5 | 8 |

| 19 | 2.0 | 8 |

| 19 | 2.5 | 8 |

The dataset is now “tidy” because: (1) each variable forms a column, (2) each observation forms a row, and (3) each type of observational unit forms a table (in this case, our observational unit is the Alcohol Purchase Task data). To learn more about the benefits of tidy data, readers are encouraged to consult Hadley Wikham’s essay on Tidy Data.

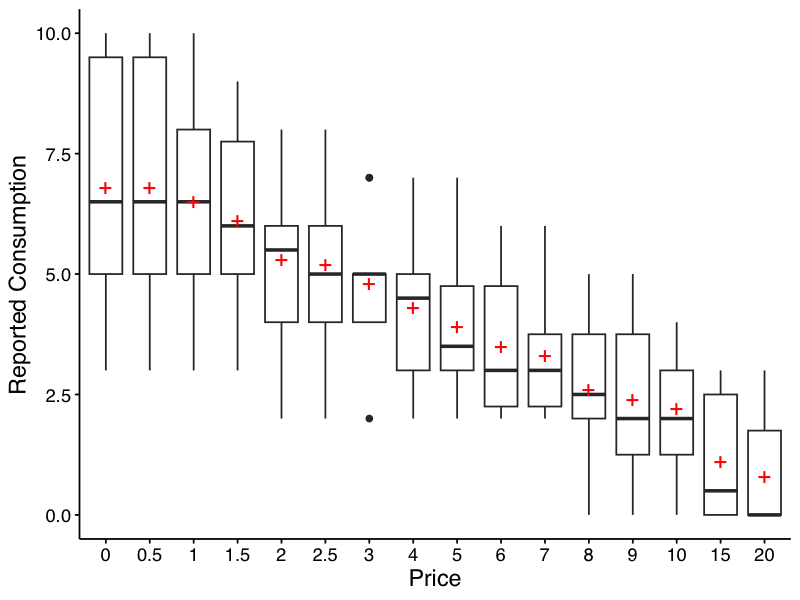

Descriptive values of responses at each price can be obtained easily.

The resulting table includes mean, standard deviation, proportion of

zeros, number of NAs, and minimum and maximum values. If

bwplot = TRUE, a box-and-whisker plot is also created and

saved. By default, this location is a folder named “plots” one level up

from the current working directory. The user may additionally specify

the directory that the plot should save into, the type of file (either

"png" or "pdf"), and the filename. Notice the

red crosses indicate the mean. Defaults are shown here:

GetDescriptives(dat = apt, bwplot = FALSE, outdir = "../plots/", device = "png",

filename = "bwplot")To actually run the code and generate the file, we will turn

bwplot = TRUE. The function will create a folder one level

higher than the current folder (i.e., the ../ portion) and

save the file, “bwplot.png” in the folder.

GetDescriptives(dat = apt, bwplot = TRUE, outdir = plotdir, device = "png",

filename = "bwplot")

And here is the table that is returned from the function:

| Price | Mean | Median | SD | PropZeros | NAs | Min | Max |

|---|---|---|---|---|---|---|---|

| 0 | 6.8 | 6.5 | 2.62 | 0.0 | 0 | 3 | 10 |

| 0.5 | 6.8 | 6.5 | 2.62 | 0.0 | 0 | 3 | 10 |

| 1 | 6.5 | 6.5 | 2.27 | 0.0 | 0 | 3 | 10 |

| 1.5 | 6.1 | 6.0 | 1.91 | 0.0 | 0 | 3 | 9 |

| 2 | 5.3 | 5.5 | 1.89 | 0.0 | 0 | 2 | 8 |

| 2.5 | 5.2 | 5.0 | 1.87 | 0.0 | 0 | 2 | 8 |

| 3 | 4.8 | 5.0 | 1.48 | 0.0 | 0 | 2 | 7 |

| 4 | 4.3 | 4.5 | 1.57 | 0.0 | 0 | 2 | 7 |

| 5 | 3.9 | 3.5 | 1.45 | 0.0 | 0 | 2 | 7 |

| 6 | 3.5 | 3.0 | 1.43 | 0.0 | 0 | 2 | 6 |

| 7 | 3.3 | 3.0 | 1.34 | 0.0 | 0 | 2 | 6 |

| 8 | 2.6 | 2.5 | 1.51 | 0.1 | 0 | 0 | 5 |

| 9 | 2.4 | 2.0 | 1.58 | 0.1 | 0 | 0 | 5 |

| 10 | 2.2 | 2.0 | 1.32 | 0.1 | 0 | 0 | 4 |

| 15 | 1.1 | 0.5 | 1.37 | 0.5 | 0 | 0 | 3 |

| 20 | 0.8 | 0.0 | 1.14 | 0.6 | 0 | 0 | 3 |

There are certain instances in which data are to be modified before fitting, for example when using an equation that logarithmically transforms y values. The following function can help with modifying data:

nrepl indicates number of replacement 0 values,

either as an integer or "all". If this value is an integer,

n, then the first n 0s will be

replaced.

replnum indicates the number that should replace 0

values

rem0 removes all zeros

remq0e removes y value where x (or price) equals

0

replfree replaces where x (or price) equals 0 with a

specified number

ChangeData(dat = apt, nrepl = 1, replnum = 0.01, rem0 = FALSE, remq0e = FALSE,

replfree = NULL)Using the following function, we can examine the consistency of demand data using Stein et al.’s (2015) alogrithm for identifying unsystematic responses. Default values shown, but they can be customized.

CheckUnsystematic(dat = apt, deltaq = 0.025, bounce = 0.1, reversals = 0, ncons0 = 2)| id | TotalPass | DeltaQ | DeltaQPass | Bounce | BouncePass | Reversals | ReversalsPass | NumPosValues |

|---|---|---|---|---|---|---|---|---|

| 19 | 3 | 0.2112 | Pass | 0 | Pass | 0 | Pass | 16 |

| 30 | 3 | 0.1437 | Pass | 0 | Pass | 0 | Pass | 16 |

| 38 | 3 | 0.7885 | Pass | 0 | Pass | 0 | Pass | 14 |

| 60 | 3 | 0.9089 | Pass | 0 | Pass | 0 | Pass | 14 |

| 68 | 3 | 0.9089 | Pass | 0 | Pass | 0 | Pass | 14 |

Results of the analysis return both empirical and derived measures for use in additional analyses and model specification. Equations include the linear model, exponential model, and exponentiated model. Soon, I will be including the nonlinear mixed effects model, mixed effects versions of the exponential and exponentiated model, and others. However, currently these models are not yet supported.

Empirical measures can be obtained separately on their own:

GetEmpirical(dat = apt)| id | Intensity | BP0 | BP1 | Omaxe | Pmaxe |

|---|---|---|---|---|---|

| 19 | 10 | NA | 20 | 45 | 15 |

| 30 | 3 | NA | 20 | 20 | 20 |

| 38 | 4 | 15 | 10 | 21 | 7 |

| 60 | 10 | 15 | 10 | 24 | 8 |

| 68 | 10 | 15 | 10 | 36 | 9 |

FitCurves() has several important arguments that can be

passed. For the purposes of this document, focus will be on the two

contemporary demand equations.

equation = "hs" is the default but can accept the

character strings "linear", "hs", or

"koff", the latter two of which are the contemporary

equations proposed by Hursh &

Silberberg (2008) and Koffarnus et

al. (2015), respectively.

k can take accept a specific number but by default

will be calculated based on the maximum and minimum y values of the

entire sample and adding .5. Adding this amount was originally proposed

by Steven R. Hursh in an early iteration of a Microsoft Excel

spreadsheet used to calculate demand metrics. This adjustment was

adopted for two reasons. First, when fitting \(Q_0\) as a derived parameter, the value may

exceed the empirically observed intensity value. Thus, a k value

calculated based only on the observed range of data may underestimate

the full fitted range of the curve. Second, we have found that values of

\(\alpha\) (as well as values that rely

on \(\alpha\), i.e. approximate \(P_{max}\)) display greater discrepancies

when smaller values of k are used compared to larger values of k. Other

options include "ind", which will calculate k based on

individual basis, "fit", which will fit k as a free

parameter on an individual basis, "share", which will fit k

as a single shared parameter across all data sets (while fitting

individual \(Q_0\) and \(\alpha\)).

agg = NULL is the default, which means no

aggregation. When agg = "Mean", models are fit to the

averaged data disregarding any error. When agg = "Pooled",

all data are used and clustering within individual is ignored.

detailed = FALSE is the default. This will output a

single dataframe of results, as shown below. When

detailed = TRUE, the output is a 3 element list that

includes (1) dataframe of results, (2) list of nonlinear regression

model objects, (3) list of dataframes containing predicted x and y

values (to be used in subsequent plotting), and (4) list of individual

dataframes used in fitting.

lobound and hibound can accept named

vectors that will be used as lower and upper bounds, respectively during

fitting. If k = "fit", then it should look as follows

(values are nonspecific):

lobound = c("q0" = 0, "k" = 0, "alpha" = 0) and

hibound = c("q0" = 25, "k" = 10, "alpha" = 1). If

k is not being fit as a parameter, then only

"q0" and "alpha" should be used in

bounding.

Note: Fitting with an equation (e.g., "linear",

"hs") that doesn’t work happily with zero consumption

values results in the following. One, a message will appear saying that

zeros are incompatible with the equation. Two, because zeros are removed

prior to finding empirical (i.e., observed) measures, resulting BP0

values will be all NAs (reflective of the data transformations). The

warning message will look as follows:

Warning message:

Zeros found in data not compatible with equation! Dropping zeros!The simplest use of FitCurves() is shown here, only

needing to specify dat and equation. All other

arguments shown are set to their default values.

FitCurves(dat = apt, equation = "hs", agg = NULL, detailed = FALSE,

xcol = "x", ycol = "y", idcol = "id", groupcol = NULL)Which is equivalent to:

FitCurves(dat = apt, equation = "hs")Note that this ouput returns a message

(No k value specified. Defaulting to empirical mean range +.5)

and the aforementioned warning

(Warning message: Zeros found in data not compatible with equation! Dropping zeros!).

With detailed = FALSE, the only output is the dataframe of

results (broken up to show the different types of results). This example

fits the exponential equation proposed by Hursh &

Silberberg (2008):

| id | Intensity | BP0 | BP1 | Omaxe | Pmaxe |

|---|---|---|---|---|---|

| 19 | 10 | NA | 20 | 45 | 15 |

| 30 | 3 | NA | 20 | 20 | 20 |

| 38 | 4 | NA | 10 | 21 | 7 |

| 60 | 10 | NA | 10 | 24 | 8 |

| 68 | 10 | NA | 10 | 36 | 9 |

Empirical Measures

| Equation | Q0d | K | Alpha | R2 |

|---|---|---|---|---|

| hs | 10.475734 | 1.031479 | 0.0046571 | 0.9660008 |

| hs | 2.932406 | 1.031479 | 0.0134557 | 0.7922379 |

| hs | 4.523155 | 1.031479 | 0.0087935 | 0.8662632 |

| hs | 10.492133 | 1.031479 | 0.0102231 | 0.9664814 |

| hs | 10.651760 | 1.031479 | 0.0061262 | 0.9699408 |

Fitted Measures

| Q0se | Alphase | N | AbsSS | SdRes | Q0Low | Q0High | AlphaLow | AlphaHigh |

|---|---|---|---|---|---|---|---|---|

| 0.4159581 | 0.0002358 | 16 | 0.0193354 | 0.0371632 | 9.583593 | 11.367876 | 0.0041515 | 0.0051628 |

| 0.2506946 | 0.0017321 | 16 | 0.0978350 | 0.0835955 | 2.394720 | 3.470093 | 0.0097408 | 0.0171706 |

| 0.2357693 | 0.0008878 | 14 | 0.0259083 | 0.0464653 | 4.009458 | 5.036853 | 0.0068592 | 0.0107277 |

| 0.6219724 | 0.0005118 | 14 | 0.0236652 | 0.0444083 | 9.136972 | 11.847295 | 0.0091080 | 0.0113382 |

| 0.3841063 | 0.0002713 | 14 | 0.0109439 | 0.0301992 | 9.814865 | 11.488656 | 0.0055350 | 0.0067173 |

Uncertainty and Model Information

| EV | Omaxd | Pmaxd | Omaxa |

|---|---|---|---|

| 2.0496977 | 45.49394 | 14.393108 | 47.84770 |

| 0.7094191 | 15.74587 | 17.796228 | 16.56052 |

| 1.0855465 | 24.09418 | 17.654531 | 25.34076 |

| 0.9337419 | 20.72481 | 6.546547 | 21.79707 |

| 1.5581899 | 34.58471 | 10.760891 | 36.37405 |

Derived Measures

Here, the simplest form is shown specifying another equation,

"koff". This fits the modified exponential equation

proposed by Koffarnus et

al. (2015):

FitCurves(dat = apt, equation = "koff")| id | Intensity | BP0 | BP1 | Omaxe | Pmaxe |

|---|---|---|---|---|---|

| 19 | 10 | NA | 20 | 45 | 15 |

| 30 | 3 | NA | 20 | 20 | 20 |

| 38 | 4 | 15 | 10 | 21 | 7 |

| 60 | 10 | 15 | 10 | 24 | 8 |

| 68 | 10 | 15 | 10 | 36 | 9 |

Empirical Measures

| Equation | Q0d | K | Alpha | R2 |

|---|---|---|---|---|

| koff | 10.131767 | 1.429419 | 0.0029319 | 0.9668576 |

| koff | 2.989613 | 1.429419 | 0.0093716 | 0.8136932 |

| koff | 4.607551 | 1.429419 | 0.0070562 | 0.8403625 |

| koff | 10.371088 | 1.429419 | 0.0068127 | 0.9659117 |

| koff | 10.703627 | 1.429419 | 0.0044361 | 0.9444897 |

Fitted Measures

| Q0se | Alphase | N | AbsSS | SdRes | Q0Low | Q0High | AlphaLow | AlphaHigh |

|---|---|---|---|---|---|---|---|---|

| 0.2438729 | 0.0001663 | 16 | 2.908243 | 0.4557758 | 9.608712 | 10.654822 | 0.0025752 | 0.0032886 |

| 0.1721284 | 0.0013100 | 16 | 1.490454 | 0.3262837 | 2.620434 | 3.358792 | 0.0065620 | 0.0121812 |

| 0.3078231 | 0.0010631 | 16 | 4.429941 | 0.5625161 | 3.947336 | 5.267766 | 0.0047761 | 0.0093362 |

| 0.4069382 | 0.0004577 | 16 | 5.010982 | 0.5982703 | 9.498292 | 11.243884 | 0.0058310 | 0.0077945 |

| 0.4677467 | 0.0003736 | 16 | 8.350830 | 0.7723263 | 9.700410 | 11.706844 | 0.0036349 | 0.0052373 |

Uncertainty and Model Information

| EV | Omaxd | Pmaxd | Omaxa |

|---|---|---|---|

| 1.9957818 | 46.56622 | 15.140905 | 46.70800 |

| 0.6243741 | 14.56810 | 16.052915 | 14.61245 |

| 0.8292621 | 19.34861 | 13.833934 | 19.40752 |

| 0.8588915 | 20.03993 | 6.365580 | 20.10095 |

| 1.3190323 | 30.77608 | 9.472147 | 30.86979 |

Derived Measures

By specifying agg = "Mean", y values at each x value are

aggregated and a single curve is fit to the data (disregarding error

around each averaged point):

FitCurves(dat = apt, equation = "hs", agg = "Mean")| id | Intensity | BP0 | BP1 | Omaxe | Pmaxe |

|---|---|---|---|---|---|

| mean | 6.8 | NA | 20 | 23.1 | 7 |

Empirical Measures

| Equation | Q0d | K | Alpha | R2 |

|---|---|---|---|---|

| hs | 7.637436 | 1.429419 | 0.0066817 | 0.9807508 |

Fitted Measures

| Q0se | Alphase | N | AbsSS | SdRes | Q0Low | Q0High | AlphaLow | AlphaHigh |

|---|---|---|---|---|---|---|---|---|

| 0.3258955 | 0.0002218 | 16 | 0.02187 | 0.039524 | 6.93846 | 8.336413 | 0.0062059 | 0.0071574 |

Uncertainty and Model Information

| EV | Omaxd | Pmaxd | Omaxa |

|---|---|---|---|

| 0.875742 | 20.43309 | 8.813584 | 20.49531 |

Derived Measures

By specifying agg = "Pooled", y values at each x value

are aggregated and a single curve is fit to the data and error around

each averaged point (but disregarding within-subject clustering):

FitCurves(dat = apt, equation = "hs", agg = "Pooled")| id | Intensity | BP0 | BP1 | Omaxe | Pmaxe |

|---|---|---|---|---|---|

| pooled | 6.8 | NA | 20 | 23.1 | 7 |

Empirical Measures

| Equation | Q0d | K | Alpha | R2 |

|---|---|---|---|---|

| hs | 6.592488 | 1.031479 | 0.0085032 | 0.460412 |

Fitted Measures

| Q0se | Alphase | N | AbsSS | SdRes | Q0Low | Q0High | AlphaLow | AlphaHigh |

|---|---|---|---|---|---|---|---|---|

| 0.4260507 | 0.0007125 | 146 | 4.677846 | 0.1802361 | 5.750367 | 7.434609 | 0.0070949 | 0.0099115 |

Uncertainty and Model Information

| EV | Omaxd | Pmaxd | Omaxa |

|---|---|---|---|

| 1.122607 | 24.91675 | 12.52644 | 26.20589 |

Derived Measures

As mentioned earlier, in the function FitCurves, when

k = "share" this parameter will be a shared parameter

across all datasets (globally) while estimating \(Q_0\) and \(\alpha\) locally. While this works, it may

take some time with larger sample sizes.

FitCurves(dat = apt, equation = "hs", k = "share")| id | Intensity | BP0 | BP1 | Omaxe | Pmaxe |

|---|---|---|---|---|---|

| 19 | 10 | NA | 20 | 45 | 15 |

| 30 | 3 | NA | 20 | 20 | 20 |

| 38 | 4 | NA | 10 | 21 | 7 |

| 60 | 10 | NA | 10 | 24 | 8 |

| 68 | 10 | NA | 10 | 36 | 9 |

Empirical Measures

| Equation | Q0d | K | Alpha | R2 |

|---|---|---|---|---|

| hs | 10.014576 | 3.31833 | 0.0011616 | 0.9820968 |

| hs | 2.766313 | 3.31833 | 0.0033331 | 0.7641766 |

| hs | 4.485810 | 3.31833 | 0.0024580 | 0.8803145 |

| hs | 9.721379 | 3.31833 | 0.0024219 | 0.9705985 |

| hs | 10.293139 | 3.31833 | 0.0015879 | 0.9722310 |

Fitted Measures

| Q0se | Alphase | N | AbsSS | SdRes | Q0Low | Q0High | AlphaLow | AlphaHigh |

|---|---|---|---|---|---|---|---|---|

| 0.2429150 | 0.0000308 | 16 | 0.0101816 | 0.0269677 | 9.493575 | 10.535577 | 0.0010955 | 0.0012277 |

| 0.2192797 | 0.0003739 | 16 | 0.1110490 | 0.0890622 | 2.296005 | 3.236621 | 0.0025312 | 0.0041350 |

| 0.2074990 | 0.0001963 | 14 | 0.0231862 | 0.0439566 | 4.033709 | 4.937912 | 0.0020302 | 0.0028858 |

| 0.4371060 | 0.0000778 | 14 | 0.0207584 | 0.0415916 | 8.769006 | 10.673751 | 0.0022523 | 0.0025914 |

| 0.3179671 | 0.0000523 | 14 | 0.0101100 | 0.0290259 | 9.600348 | 10.985930 | 0.0014740 | 0.0017018 |

Uncertainty and Model Information

| EV | Omaxd | Pmaxd | Omaxa |

|---|---|---|---|

| 1.4241862 | 44.55169 | 13.160540 | 44.55206 |

| 0.4963281 | 15.52624 | 16.603785 | 15.52637 |

| 0.6730395 | 21.05416 | 13.884786 | 21.05433 |

| 0.6830746 | 21.36808 | 6.502492 | 21.36826 |

| 1.0418474 | 32.59129 | 9.366898 | 32.59155 |

Derived Measures

When one has multiple groups, it may be beneficial to compare whether

separate curves are preferred over a single curve. This is accomplished

by the Extra Sum-of-Squares F-test. This function (using the

argument compare) will determine whether a single \(\alpha\) or a single \(Q_0\) is better than multiple \(\alpha\)s or \(Q_0\)s. A single curve will be fit, the

residual deviations calculated and those residuals are compared to

residuals obtained from multiple curves. A resulting F

statistic will be reporting along with a p value.

## setting the seed initializes the random number generator so results will be

## reproducible

set.seed(1234)

## manufacture random grouping

apt$group <- NA

apt[apt$id %in% sample(unique(apt$id), length(unique(apt$id))/2), "group"] <- "a"

apt$group[is.na(apt$group)] <- "b"

## take a look at what the new groupings look like in long form

knitr::kable(apt[1:20, ])| id | x | y | group |

|---|---|---|---|

| 19 | 0.0 | 10 | a |

| 19 | 0.5 | 10 | a |

| 19 | 1.0 | 10 | a |

| 19 | 1.5 | 8 | a |

| 19 | 2.0 | 8 | a |

| 19 | 2.5 | 8 | a |

| 19 | 3.0 | 7 | a |

| 19 | 4.0 | 7 | a |

| 19 | 5.0 | 7 | a |

| 19 | 6.0 | 6 | a |

| 19 | 7.0 | 6 | a |

| 19 | 8.0 | 5 | a |

| 19 | 9.0 | 5 | a |

| 19 | 10.0 | 4 | a |

| 19 | 15.0 | 3 | a |

| 19 | 20.0 | 2 | a |

| 30 | 0.0 | 3 | b |

| 30 | 0.5 | 3 | b |

| 30 | 1.0 | 3 | b |

| 30 | 1.5 | 3 | b |

## in order for this to run, you will have had to run the code immediately

## preceeding (i.e., the code to generate the groups)

ef <- ExtraF(dat = apt, equation = "koff", k = 2, groupcol = "group", verbose = TRUE)[1] "Null hypothesis: alpha same for all data sets"

[1] "Alternative hypothesis: alpha different for each data set"

[1] "Conclusion: fail to reject the null hypothesis"

[1] "F(1,156) = 0.0298, p = 0.8631"A summary table (broken up here for ease of display) will be created

when the option verbose = TRUE. This table can be accessed

as the dfres object resulting from ExtraF. In

the example above, we can access this summary table using

ef$dfres:

| Group | Q0d | K | R2 | Alpha |

|---|---|---|---|---|

| Shared | NA | NA | NA | NA |

| a | 8.489634 | 2 | 0.6206444 | 0.0040198 |

| b | 5.848119 | 2 | 0.6206444 | 0.0040198 |

| Not Shared | NA | NA | NA | NA |

| a | 8.503442 | 2 | 0.6448801 | 0.0040518 |

| b | 5.822075 | 2 | 0.5242825 | 0.0039376 |

Fitted Measures

| Group | N | AbsSS | SdRes |

|---|---|---|---|

| Shared | NA | NA | NA |

| a | 160 | 387.0945 | 1.570213 |

| b | 160 | 387.0945 | 1.570213 |

| Not Shared | NA | NA | NA |

| a | 80 | 249.2764 | 1.787695 |

| b | 80 | 137.7440 | 1.328890 |

Uncertainty and Model Information

| Group | EV | Omaxd | Pmaxd |

|---|---|---|---|

| Shared | NA | NA | NA |

| a | 0.8795301 | 22.63159 | 8.453799 |

| b | 0.8795301 | 22.63159 | 12.272265 |

| Not Shared | NA | NA | NA |

| a | 0.8725741 | 22.45260 | 8.373320 |

| b | 0.8978945 | 23.10414 | 12.584550 |

Derived Measures

| Group | Omaxa | Notes |

|---|---|---|

| Shared | NA | NA |

| a | 22.63190 | converged |

| b | 22.63190 | converged |

| Not Shared | NA | NA |

| a | 22.45291 | converged |

| b | 23.10445 | converged |

Convergence and Summary Information

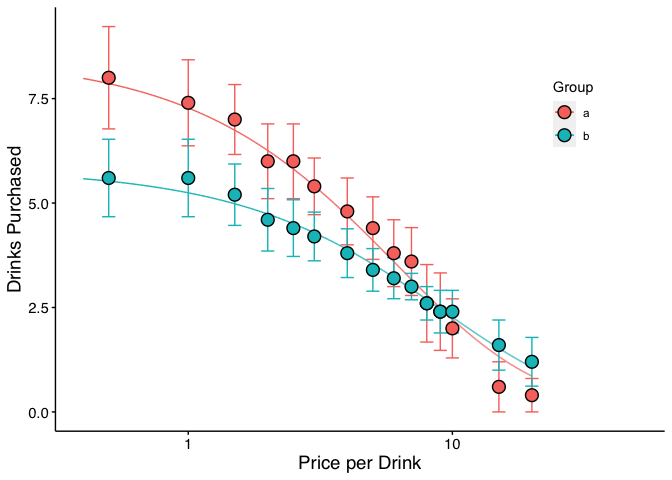

When verbose = TRUE, objects from the result can be used

in subsequent graphing. The following code generates a plot of our two

groups. We can use the predicted values already generated from the

ExtraF function by accessing the newdat

object. In the example above, we can access these predicted values using

ef$newdat. Note that we keep the linear scaling of y given

we used Koffarnus et

al. (2015)’s equation fitted to the data.

## be sure that you've loaded the tidyverse package (e.g., library(tidyverse))

ggplot(apt, aes(x = x, y = y, group = group)) +

## the predicted lines from the sum of squares f-test can be used in subsequent

## plots by calling data = ef$newdat

geom_line(aes(x = x, y = y, group = group, color = group),

data = ef$newdat[ef$newdat$x >= .1, ]) +

stat_summary(fun.data = mean_se, aes(width = .05, color = group),

geom = "errorbar") +

stat_summary(fun.y = mean, aes(fill = group), geom = "point", shape = 21,

color = "black", stroke = .75, size = 4) +

scale_x_log10(limits = c(.4, 50), breaks = c(.1, 1, 10, 100)) +

scale_color_discrete(name = "Group") +

scale_fill_discrete(name = "Group") +

labs(x = "Price per Drink", y = "Drinks Purchased") +

theme(legend.position = c(.85, .75)) +

## theme_apa is a beezdemand function used to change the theme in accordance

## with American Psychological Association style

theme_apa()

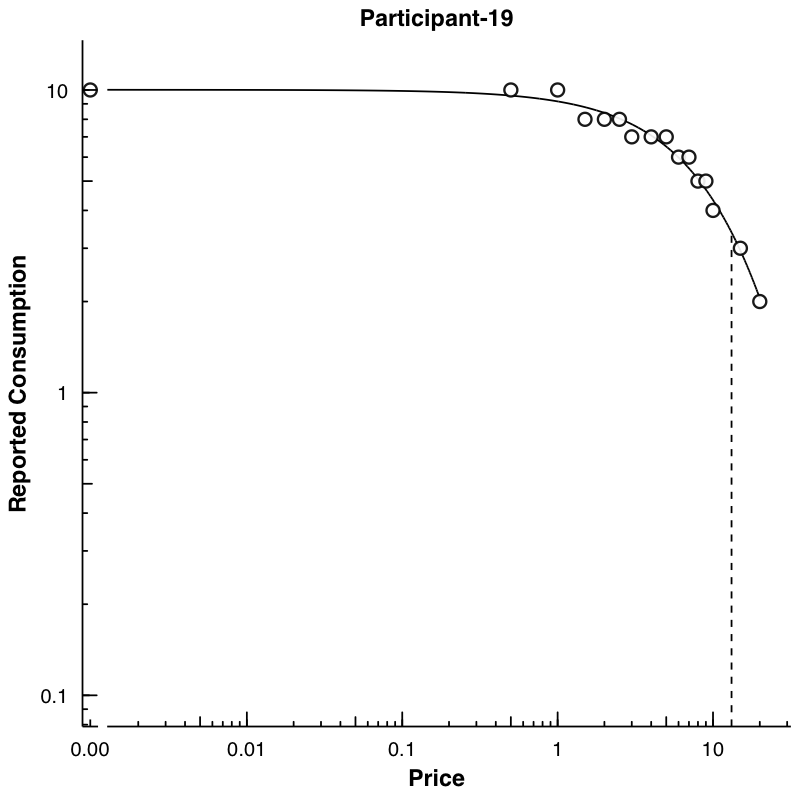

Plots can be created using the PlotCurves function. This

function takes the output from FitCurves when the argument

from FitCurves, detailed = TRUE. The default

will be to save figures into a plots folder created one directory above

the current working directory. Figures can be saved as either PNG or

PDF. If the argument ask = TRUE, then plots will be shown

interactively and not saved (ask = FALSE is the default).

Graphs can automatically be created at both an aggregate and individual

level.

As a demonstration, let’s first use FitCurves on the

apt dataset, specifying k = "share" and

detailed = T. This will return a list of objects to use in

PlotCurves. In PlotCurves, we will feed in our

new object, out, and tell the function to save the plots in

the directory "../plots/" and ask = FALSE

because we don’t want R to interactively show us each plot.

Because we have 10 datasets in our apt example, 10 plots

will be created and saved in the "../plots/" directory.

out <- FitCurves(dat = apt, equation = "hs", k = "share", detailed = T)Warning: Zeros found in data not compatible with equation! Dropping zeros!

Beginning search for best-starting k

Best k fround at 0.93813356574003 = err: 0.744881846162718

Searching for shared K, this can take a while...PlotCurves(dat = out, outdir = plotdir, device = "png", ask = F)10 plots saved in man/figures/

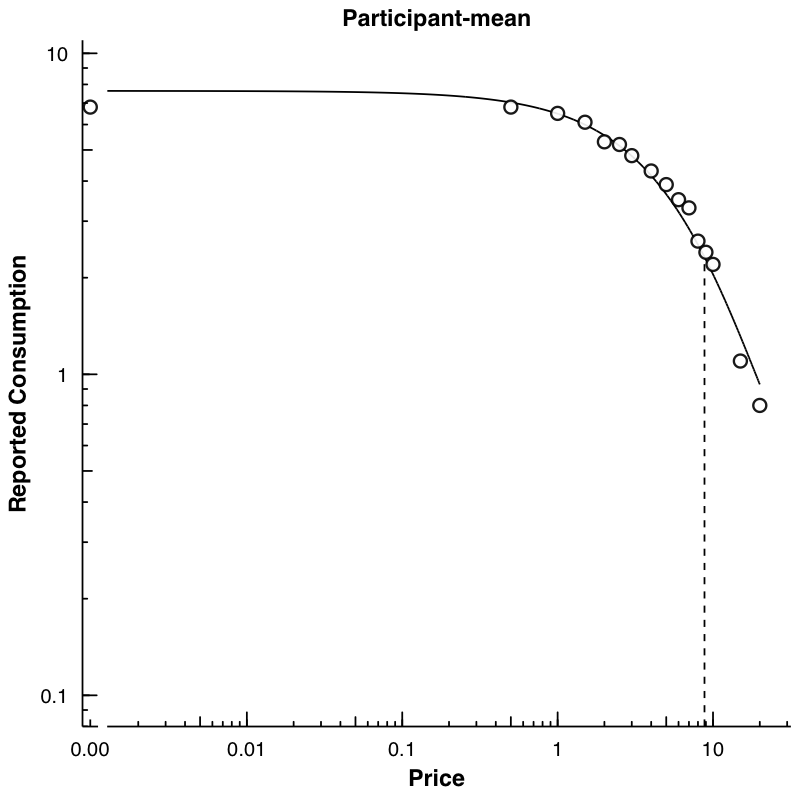

We can also make a plot of the mean data. Here, we again use

FitCurves, this time calculating a k from the observed

range of the data (thus not specifying any k) and specifying

agg = "Mean".

mn <- FitCurves(dat = apt, equation = "hs", agg = "Mean", detailed = T)No k value specified. Defaulting to empirical mean range +.5PlotCurves(dat = mn, outdir = plotdir, device = "png", ask = F)1 plots saved in man/figures/list.files("../plots/") [1] "Participant-106.png" "Participant-113.png" "Participant-142.png"

[4] "Participant-156.png" "Participant-188.png" "Participant-19.png"

[7] "Participant-30.png" "Participant-38.png" "Participant-60.png"

[10] "Participant-68.png" "Participant-mean.png"

To learn more about a function and what arguments it takes, type “?” in front of the function name.

?CheckUnsystematicCheckUnsystematic package:beezdemand R Documentation

Systematic Purchase Task Data Checker

Description:

Applies Stein, Koffarnus, Snider, Quisenberry, & Bickels (2015)

criteria for identification of nonsystematic purchase task data.

Usage:

CheckUnsystematic(dat, deltaq = 0.025, bounce = 0.1, reversals = 0,

ncons0 = 2)

Arguments:

dat: Dataframe in long form. Colums are id, x, y.

deltaq: Numeric vector of length equal to one. The criterion by which

the relative change in quantity purchased will be compared.

Relative changes in quantity purchased below this criterion

will be flagged. Default value is 0.025.

bounce: Numeric vector of length equal to one. The criterion by which

the number of price-to-price increases in consumption that

exceed 25% of initial consumption at the lowest price,

expressed relative to the total number of price increments,

will be compared. The relative number of price-to-price

increases above this criterion will be flagged. Default value

is 0.10.

reversals:Numeric vector of length equal to one. The criterion by

which the number of reversals from number of consecutive (see

ncons0) 0s will be compared. Number of reversals above this

criterion will be flagged. Default value is 0.

ncons0: Number of consecutive 0s prior to a positive value is used to

flag for a reversal. Value can be either 1 (relatively more

conservative) or 2 (default; as recommended by Stein et al.,

(2015).

Details:

This function applies the 3 criteria proposed by Stein et al.,

(2015) for identification of nonsystematic purchase task data. The

three criteria include trend (deltaq), bounce, and reversals from

0. Also reports number of positive consumption values.

Value:

Dataframe

Author(s):

Brent Kaplan <bkaplan.ku@gmail.com>

Examples:

## Using all default values

CheckUnsystematic(apt, deltaq = 0.025, bounce = 0.10, reversals = 0, ncons0 = 2)

## Specifying just 1 zero to flag as reversal

CheckUnsystematic(apt, deltaq = 0.025, bounce = 0.10, reversals = 0, ncons0 = 1)Shawn P. Gilroy, Contributor GitHub

Derek D. Reed, Applied Behavioral Economics Laboratory

Mikhail N. Koffarnus, Addiction Recovery Research Center

Steven R. Hursh, Institutes for Behavior Resources, Inc.

Paul E. Johnson, Center for Research Methods and Data Analysis, University of Kansas

Peter G. Roma, Institutes for Behavior Resources, Inc.

W. Brady DeHart, Addiction Recovery Research Center

Michael Amlung, Cognitive Neuroscience of Addictions Laboratory

Special thanks to the following people who helped provide feedback on this document:

Alexandra M. Mellis

Mr. Jeremiah “Downtown Jimbo Brown” Brown

Gideon Naudé

Reed, D. D., Niileksela, C. R., & Kaplan, B. A. (2013). Behavioral economics: A tutorial for behavior analysts in practice. Behavior Analysis in Practice, 6 (1), 34–54. https://doi.org/10.1007/BF03391790

Reed, D. D., Kaplan, B. A., & Becirevic, A. (2015). Basic research on the behavioral economics of reinforcer value. In Autism Service Delivery (pp. 279-306). Springer New York. https://doi.org/10.1007/978-1-4939-2656-5_10

Hursh, S. R., & Silberberg, A. (2008). Economic demand and essential value. Psychological Review, 115 (1), 186-198. https://dx.doi.org/10.1037/0033-295X.115.1.186

Koffarnus, M. N., Franck, C. T., Stein, J. S., & Bickel, W. K. (2015). A modified exponential behavioral economic demand model to better describe consumption data. Experimental and Clinical Psychopharmacology, 23 (6), 504-512. https://dx.doi.org/10.1037/pha0000045

Stein, J. S., Koffarnus, M. N., Snider, S. E., Quisenberry, A. J., & Bickel, W. K. (2015). Identification and management of nonsystematic purchase task data: Toward best practice. Experimental and Clinical Psychopharmacology 23 (5), 377-386. https://dx.doi.org/10.1037/pha0000020

Hursh, S. R., Raslear, T. G., Shurtleff, D., Bauman, R., & Simmons, L. (1988). A cost‐benefit analysis of demand for food. Journal of the Experimental Analysis of Behavior, 50 (3), 419-440. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC1338908/